Blackjack Strategy

1. Basic Strategy Calculation (Picking the right horses / choosing the best stocks)

1.1. Expected Value (EV) for Each Action

The optimal strategy is derived by calculating the Expected Value (EV) for each possible action (Hit, Stand, Double, Split, Surrender) based on the player’s hand and the dealer’s upcard.

-

Formula:

\[EV = \sum \Big( P_{\text{outcome}} \times \text{Payoff}_{\text{outcome}} \Big)\]- $P_{\text{outcome}}$: Probability of a specific outcome (e.g., win, lose, push).

- $\text{Payoff}_{\text{outcome}}$: Payout for the outcome (e.g., 1:1, 3:2 for Blackjack).

1.2. Probability Calculation

-

Dealer’s Final Hand Probability:

Use combinatorial analysis to calculate the probability of the dealer busting or reaching specific totals (17–21) based on their upcard.

- Example: Dealer upcard = 6. Probability of busting ≈ 42.315%.

-

Player’s Hand Probability:

Calculate the probability of improving a hand (e.g., hitting 12 vs. dealer 2).

1.3. Decision Matrix

Construct a matrix comparing the EV of all actions:

| Player Hand (Hard) | Dealer Upcard | EV(Hit) | EV(Stand) | EV(Double) | Optimal Action |

|---|---|---|---|---|---|

| 16 | 7 | -0.41 | -0.48 | -0.83 | Stand |

2. Card Counting Systems

2.1. High-Low System

-

Card Values:

Card Range Weight 2–6 +1 7–9 0 10, J, Q, K, A -1 -

Running Count (RC):

\[RC = \sum \Big( \text{Weight of each card seen} \Big)\] -

True Count (TC):

\[TC = \frac{RC}{\text{Decks Remaining}}\]

2.2. True Count → Player Edge

-

Conversion Table:

True Count Player Edge (%) $\leq 0$ -0.5% (House Edge) $+3$ +1.5%

3. Bet Sizing Using the Kelly Criterion (Deciding when to bet / determining the optimal time to enter or exit the market)

3.1. Kelly Formula

\[f = \frac{EV}{b}\]- $f$: Fraction of bankroll to bet.

- $b$: Net odds received on the wager (for a 1:1 payout, $b = 1$).

3.2. Practical Adjustments

- Full Kelly: Aggressive (high risk).

- Fractional Kelly: \(f_{\text{adjusted}} = \frac{f}{2}\) (common for risk management).

3.3. Example Calculation

- Player Edge = 1.5%, $b = 1$: \(f = \frac{0.015}{1} = 1.5\% \quad \Rightarrow \quad \text{Bet 1.5\% of bankroll}.\)

4. Risk Management

4.1. Bankroll Requirements

- Formula:

\(\text{Minimum Bankroll} = \frac{\text{Max Expected Loss}}{\text{Risk of Ruin}}\)

- Example: To withstand a 10% Risk of Ruin, the bankroll must be at least 40× the max bet.

4.2. Stop-Loss Limits

- Set daily loss limits (e.g., 50% of the session bankroll).

5. Dynamic Strategy Adjustments

5.1. True Count-Based Modifications

| True Count | Strategy Adjustment |

|---|---|

| TC ≥ +3 😊 | Double down on 9 vs. 2–6; Split 10s vs. 5–6. |

| TC ≤ -1 😢 | Avoid splitting pairs; Surrender 16 vs. 9. |

5.2. Rule Variations Impact

- Dealer Hits Soft 17: Increases house edge by 0.2%.

- Double After Split: Adds ≈0.15% to player edge.

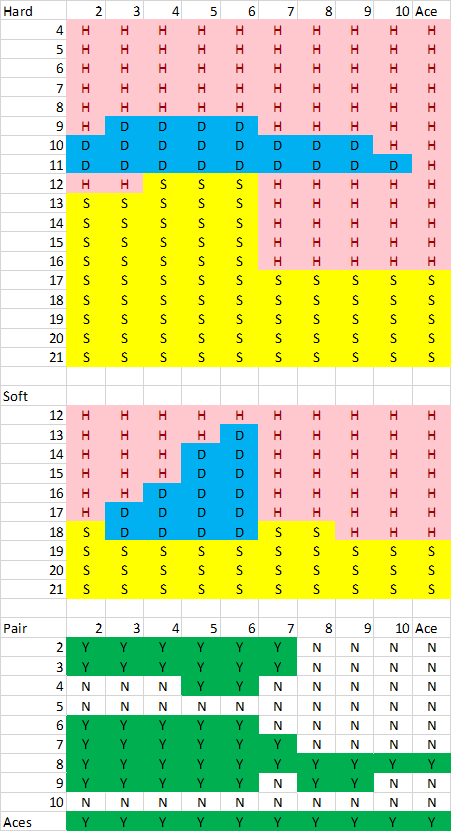

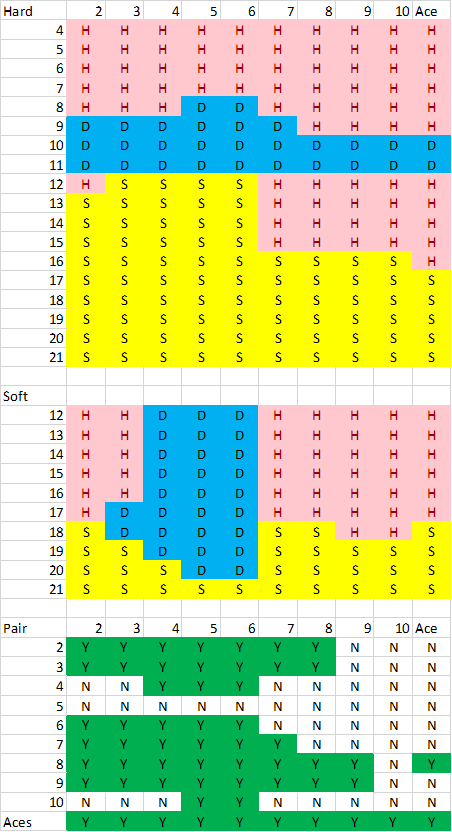

Normal Strategy and Strategy when our edge is 2.96%:

| Normal Strategy | New Strategy |

|---|---|

|

|

6. Development & Validation

6.1. Monte Carlo Simulation

Run millions of virtual hands to validate strategy profitability under different conditions.

- Track results in real sessions and adjust for deviations (e.g., bet spread, TC rounding).

6.2. Reinforcement Learning

Due to the complex state-action space (even other players’ choices influence the dealer!), reinforcement learning (RL) can optimize Blackjack strategy by learning optimal actions through trial and reward feedback in a simulated environment.

Conclusion

- Basic Strategy: Foundation based on EV maximization.

- Card Counting: Track TC to quantify player edge.

- Bet Sizing: Use the Kelly Criterion for optimal growth.

- Risk Management: Protect bankroll with stop-loss limits.

- Adaptation: Adjust for rules and TC fluctuations.

-

Previous

Failure to start kernel due to failures in importing modules from files -

Next

Belvedere trading